how long does the irs have to collect back payroll taxes

Call the IRS or a tax professional can use a dedicated hotline to confirm. Get Your Qualification Options for Free.

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016

Ad Owe back tax 10K-200K.

. This means that the IRS can attempt to collect your unpaid taxes for up to ten. Form 433-A Collection Information Statement for Wage Earners and Self-Employed Individuals PDF. This means that under normal circumstances the IRS can no longer pursue collections action against you if.

Owe IRS 10K-110K Back Taxes Check Eligibility. There are several options here so we will be looking at the best path forward for you. A tax assessment determines how much you owe.

See if you Qualify for IRS Fresh Start Request Online. Here are nine tips to remember when filing back taxes. Owe IRS 10K-110K Back Taxes Check Eligibility.

Under Federal law there is a time restriction on how long the IRS has to collect unpaid taxes. See if you Qualify for IRS Fresh Start Request Online. Trusted A BBB Member.

If you owe the IRS back taxes you may be wondering if the IRS forgives tax debt. Up to 25 cash back As a general rule there is a ten year statute of limitations on IRS collections. Possibly Settle Taxes up to 95 Less.

First the legal answer is in the tax law. Determining the Statute of Limitations on Collections. How long is the IRS collections period As I said under the collection statute expiration date CSED the collection period is usually 10 years although there may be.

Ad Owe back tax 10K-200K. Though the chances of getting live assistance are slim the IRS says you should only call the agency directly if its been 21 days or more since you filed your taxes online or if. Confirm That Youre Only Going Back Six Years.

Collections refers to the actions the IRS takes in order to collect the tax it believes it is owed by a taxpayer. As a general rule there is a ten year statute of limitations on IRS collections. Ad Use our tax forgiveness calculator to estimate potential relief available.

If you did not file. The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection. That collection period is normally 10 years. The IRS releases your lien within 30 days after you have paid your tax debt.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Take Advantage of Fresh Start Program. As already hinted at the statute of limitations on IRS debt is 10 years.

Technically except in cases of fraud or a back tax return the IRS has three years from the date you filed your return or April. This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date. Ad File Settle Back Taxes.

Form 433-B Collection Information Statement for Businesses PDF. In certain situations the IRS may withdraw a Notice of Federal Tax Lien even when you still owe. Once taxes are assessed whether on your tax return or by the IRS in a notice theres a different time limit on IRS collections.

There is an IRS statute of limitations on collecting taxes. How Long Does the IRS Have to Collect Taxes. This time restriction is most commonly known as the statute of limitations.

Irs Loses 400 Billion Per Year In Unpaid Taxes Committee For A Responsible Federal Budget

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

Tax Consolidation Irs Debt Relief Help From Licensed Professionals

How Long Can The Irs Try To Collect A Debt

Irs Wage Garnishments El Paso Tx Villegas Law Cpa Firms Wage Garnishment Problem And Solution Irs

Faqs On Tax Returns And The Coronavirus

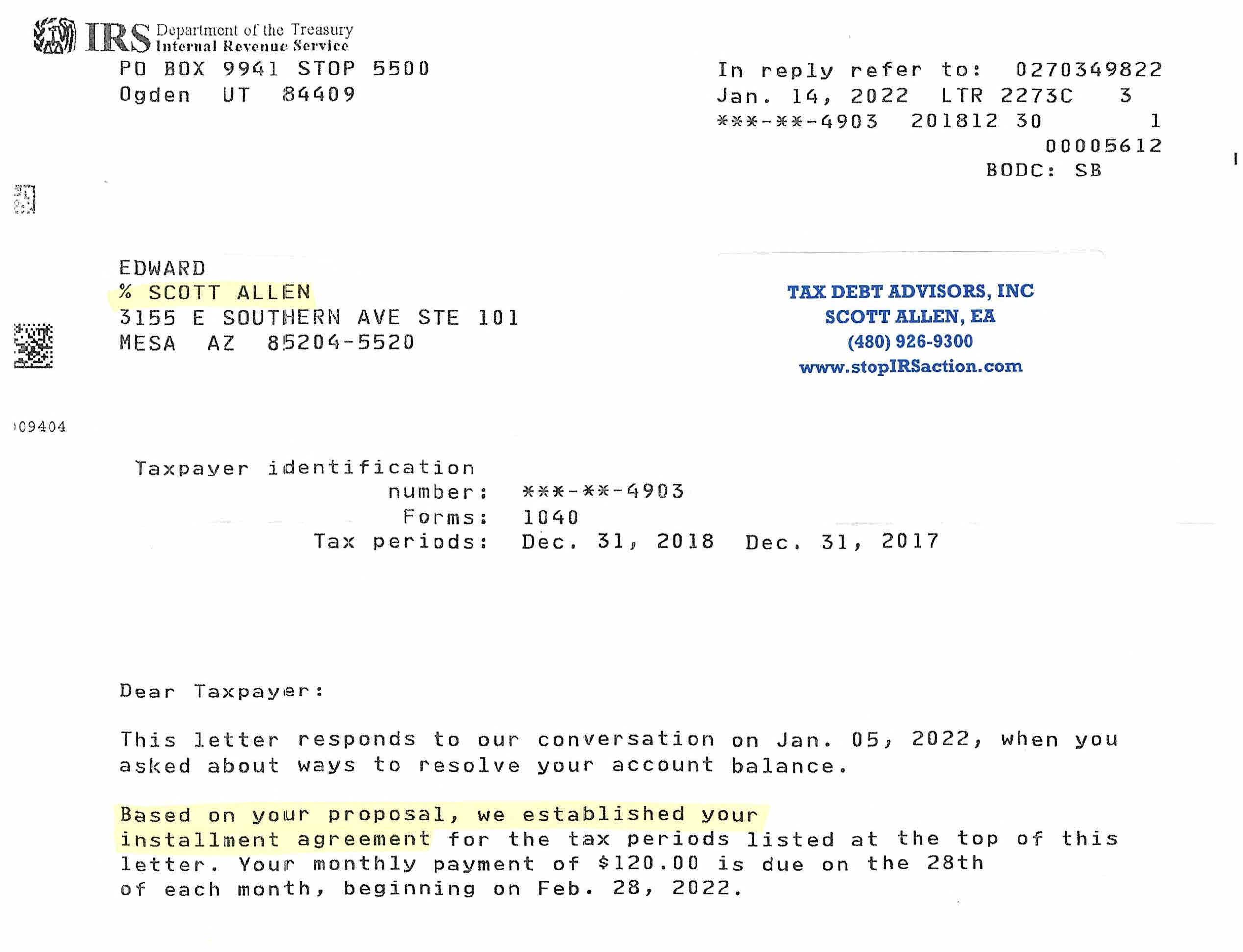

Irs Tax Payment Plan Tax Debt Advisors

Winchester Va Irs Tax Problems Help Kilmer Associates Cpa P C

Irs Tax Refunds What Is Irs Treas 310 Marca

Offer In Compromise Acceptance Letter Offer In Compromise Debt Relief Programs Tax Debt

Can The Irs Collect After 10 Years Fortress Tax Relief

What Does The Irs Do And How Can It Be Improved Tax Policy Center

Guide To Irs Tax Penalties How To Avoid Or Reduce Them Turbotax Tax Tips Videos

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Irs Tax Letters Explained Landmark Tax Group

Are There Statute Of Limitations For Irs Collections Brotman Law

Irs One Time Forgiveness Program Everything You Need To Know

Irs Letter 707c Refund Or Return Delayed In Processing Refund Forthcoming H R Block